Do you have any disability insurance? You may not be aware, but disability insurance for nurses is an important policy that protects you in case you are unable to work. In this article, we’ll share information about disability protection for nurses and how you can have income protection.

- Disability Insurance for Nurses

- What is Disability Insurance?

- Value of Disability Insurance For Nurses

- How To Get Disability Insurance

- How Much Does Disability Insurance Cost?

- How Much Does Disability Insurance Pay Nurses?

- How Does Having Individual Disability Insurance Enhance Your Employer-Provided Group Protection?

- What is Long Term Disability Insurance?

- When Should You Get Disability Insurance?

- Who Should Get Nursing Disability Insurance?

- Income Protection for Nurses

- Get a Quote from InsureSTAT

Disability Insurance for Nurses

As you read on, you’ll learn all about nursing disability insurance. As nurses, we work extremely hard. Our jobs are labor-intensive and hard on our bodies. Taking time off work due to a sickness or injury can really hurt our already tight budgets.

This is why disability insurance is so incredibly important.

What is Disability Insurance?

Disability insurance pays out cash benefits to help make up for loss of income in the event that you are unable to work for a long period of time due to a covered illness or accidental injury.

So basically, disability insurance pays you money when you can’t work due to being too sick or injured.

Value of Disability Insurance For Nurses

To really understand the value of disability insurance for nurses, let’s look at an example.

Sally is a nurse that makes about $65,000 per year. She was going to save money and just rely on Federal Government disability money if that ever happened– and she hoped it never would.

But then she got in a car accident. The other driver was not insured. She didn’t have full coverage on her own car. Her injuries put her out of work for months.

She was only able to get $1,000 a month from government disability. Her bills were much more than that.

It can happen to anyone. Unfortunately, Sally’s story is common. But if she had income protection through disability insurance, she would have been protected.

The value of long-term disability for nurses is measured by how much income you’d lose if you couldn’t work. A majority of nurses rely on their income for almost all of their living expenses. And some nurses are even the sole breadwinners supporting their entire family. To have that income disappear would be scary and devastating.

How To Get Disability Insurance

Nursing disability insurance can be obtained from a licensed insurance agent. You can shop around and find the best one for you as income protection plans from many major companies. However, we’ve simplified the process and partnered with InsureSTAT to help you get a great policy that fits your needs.

As you compare policies, definitely look for disability insurance specifically for nurses that is described as “own occupation.”. This is an insurance policy that covers those who have become disabled and are unable to perform the usual and customary duties of their own occupation. It is better than “any occupation” insurance because you are more likely to receive benefits – especially if you were currently employed when you got sick or injured.

In fact, if you try to buy a cheaper insurance that is “any occupation,” they might require you take any job you can get – even if it pays MUCH less than you made as a nurse.

Where can you get own-occupation insurance? Darras Law has a really fantastic article that outlines the best practices for finding nursing disability insurance. You can also just go into your HR office and ask them if your employer offers disability insurance. They might have some good rates. But we recommend going directly to InsureSTAT as they have great policies and cater specifically to nurses.

How Much Does Disability Insurance Cost?

The cost of your disability insurance depends on your annual salary and the type of policy you purchase. Generally, it can cost anywhere from $25 per month to as much as $500 a month.

How Much Does Disability Insurance Pay Nurses?

The amount you’ll make from disability insurance payments depends on the type of policy you purchased. But it will typically pay you about 65% of your income. Keep in mind that it doesn’t pay for medical care, it is just meant to replace lost income.

How Does Having Individual Disability Insurance Enhance Your Employer-Provided Group Protection?

Many hospitals and larger employer groups provide a Group Long Term Disability plan to replace 60% of income with stipulated monthly maximums. When premiums are paid for by the employer this typically leads to a taxable benefit to the insured when they receive benefits. What was assumed to be 60% income replacement becomes closer to 40% and the need to recoup the tax loss with an individual policy becomes critical. All individual policy benefits when paid with after tax dollars provide tax free benefits to the insured. Thus the term “supplemental disability insurance.”

What is Long Term Disability Insurance?

Long Term Disability Insurance covers you if you are unable to work for a long period of time due to covered injury or sickness. Some estimates are saying that people with long-term disability miss about 2.5 years of work.

Short-term disability typically covers time away from work for about 26 weeks.

When Should You Get Disability Insurance?

You really should invest in disability insurance as soon as you can. Don’t wait. If you wait to buy disability insurance, you are risking getting a pre-existing condition or paying more due to your age.

Who Should Get Nursing Disability Insurance?

Honestly, I believe every single nurse should have disability insurance, especially if you rely on your income for the majority of your living expenses.

The loss of income due to sickness or injuries can be devastating. You’ll be so glad you invested in a policy when you see the checks arrive.

Income Protection for Nurses

As a full-time working nurse, I think it is imperative that you get disability insurance. You need the income protection. You spend so many hours of your life taking care of others, don’t forget about yourself. The future is so uncertain, at least make sure that if something terrible happens, you are covered and safe.

Get a Quote from InsureSTAT

Are you ready to protect your income, home, and family? Get a custom disability insurance quote from InsureSTAT today!

More Professional Resources for Nurses

I hope you found this article helpful. If you learned something about nursing disability insurance, then you will enjoy these resources too.

- Hospice Nurse: What’s the Salary & Is It For You?

- All About Advanced Practice Nursing

- Nursing Informatics Guide

- Nursing Malpractice Insurance: What Is It, and Why Might I Need It?

Disclaimer: Please note that the information provided, while authoritative, is not guaranteed for accuracy and legality. The site is read by a world-wide audience and employment laws and regulations vary from state to state and country to country. Please seek legal assistance, or assistance from State, Federal, or International governmental resources, to make certain your legal interpretation and decisions are correct for your location. This information is for guidance, ideas, and assistance.

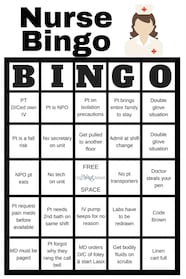

Download Nurse Bingo Today!

Liven up any shift with a fun game of bingo. See who can fill a row first!

Fill a whole card and lose grip with reality.

Your privacy is protected. We will never spam you.

Another thing to note, there is little or no “light duty” for nurses. You cannot go back to work until you are totally well. It is a liability and infection control issue for you to be working with a wrist brace on.

Disability can be complex, I have had policies that require you to be disable for 30 days prior to be paid. If you have,30 days without pay, you may already be under water financially.

I have found fellow employees do not understand the difference between FMLA and disability. FM:LA gives you the right to be off for illness or injury but it is without pay. You can be intermittently on FMLA but most disability insurances require completely off of work, continuously..

My advice: Get disability insurance and get any “buy-up” offered by your employer, you will need it.