As a nurse, you have an incredibly important role in the healthcare system. You provide essential care to patients and help them heal and recover. Yet despite your commitment to always doing the best job possible, accidents can still happen even in nursing.

And while countermeasures such as adherence to best practices are key for mitigating risk. Another proactive defense is getting malpractice insurance coverage before something goes wrong.

When practitioners make mistakes, the impact on patients can be devastating. Having this form of financial protection can not only safeguard you from legal trials but also help maintain your professional reputation should something unfortunate occur on the job that involves negligence or misconduct.

Let’s jump in to see what exactly is nursing malpractice insurance and why it’s essential for every nurse that could hurt your practice and pocketbook down the line.

- What is Nursing Malpractice Insurance?

- Types of Nursing Malpractice Liability Insurance

- How To Choose The Best Nursing Insurance?

- How Much Does Nursing Malpractice Insurance Cost?

- What Does Nursing Malpractice Insurance Cover?

- Do Nurses Need Malpractice Insurance?

- Do Nursing Students Need Malpractice Insurance?

- What Are the Risks of Practicing Without Malpractice Insurance?

- Also Check Out:

What is Nursing Malpractice Insurance?

Nursing malpractice insurance is the type of insurance that provides nurses with protection when a patient brings legal action against them.

Not only does it provide financial relief in case of an error or unfortunate circumstance, but it can also protect your license and reputation. A nursing license isn’t easy to come by, so protecting yours should be the top priority.

This type of insurance provides coverage for a variety of situations that may arise in your career. It’s like having your back covered in the legal matters of being a nurse.

As a nurse, I highly recommend that all nurses protect themselves with malpractice insurance. No matter how confident you feel about your work, it’s always better to have that extra layer of protection.

Types of Nursing Malpractice Liability Insurance

There are two different types of liability insurance available, each offering levels of protection depending on the specific needs of a nurse or facility.

- Claims-Made Policies

- Occurrence Policies

By understanding the difference between the two, nurses can make an informed decision as to which type of policy best fits their needs.

Claims-Made Policies

A claims-made policy provides coverage for claims made during the policy period. This means that if a claim is made against an insured party after the policy has expired, it will not be covered under the claims-made policy.

These are typically used for professional liability insurance, such as nursing malpractice liability insurance. It is designed to protect the insured party against claims related to errors or omissions while the policy is in effect.

This type of policy is less expensive than an occurrence policy. Still, it leaves you vulnerable to claims made after your expired policy.

Occurrence Policies

Occurrence policies provide coverage for any claims arising from incidents that occurred during the policy period, even if those incidents are reported after the policy has expired. This means that you will be protected against claims filed long after you have left a position or retired from nursing.

Most often, it is recommended that nurses opt for occurrence policies due to their higher levels of protection. However, they tend to cost more than claims-made policies, so it’s important to weigh your options carefully when choosing a policy.

How To Choose The Best Nursing Insurance?

When shopping for nursing malpractice insurance, follow these steps to find the best package.

- Do your research and take the time to read the fine print of any policy before signing on the dotted line

- Compare rates and coverage levels between providers

- Look for additional coverage options that may benefit you

- Understand what is covered and what is excluded

- Seek advice from a lawyer or financial advisor if needed

Investing in this protection will provide peace of mind and help protect you should something go wrong on the job. With the right policy, you can ensure that your practice remains safe and secure.

How Much Does Nursing Malpractice Insurance Cost?

Individual insurance is generally inexpensive. It costs about $100 per year. However, like other forms of insurance, your exact premium cost will vary depending on a few factors. The insurance cost varies by:

- How many years of experience do you have

- Your specialty

- Type of policy (tailored coverage or a standard policy).

- The amount of coverage you choose.

- The state you work in

- Your education (RN or BSN)

- Any previous claims filed against you

When it comes to malpractice insurance costs, it depends on the type of policy you choose and how much coverage you need. Generally, the more coverage you get, the higher your premium will be.

What Does Nursing Malpractice Insurance Cover?

Every insurance policy has different coverage levels and policy limits. If you are wondering about what is covered, it’s best to read the policy carefully.

Types of Claims Covered

When it comes to knowing what types of claims nursing malpractice insurance covers, it can be difficult to know for sure. However, there are a few key claims that you should be aware of.

- Misdiagnosis or failure to diagnose a medical condition

- Medication errors

- Surgical errors

- Birth injuries

- Negligent patient care

- Wrongful death

- Breach of confidentiality

- Failing to follow established protocols

- Failure to obtain patient consent

Financial Coverage

Most cases don’t make it to trial. Still, you could have to pay a hefty settlement out of pocket without proper liability coverage. But if you have a medical malpractice insurance policy, then you will get financial coverage in the following ways:

- Attorney and court fees

- Arbitration costs

- Medical and compensatory damages

- Payouts and settlements

- HIPAA Violation Fines

Now the coverage varies from company to company and policy to policy, so it’s important to ensure that you understand what your coverage includes.

Do Nurses Need Malpractice Insurance?

It is generally a good idea for nurses to have malpractice insurance, as it can protect against legal claims related to their care. Nursing is a high-risk profession; even the most competent and well-trained nurses can make mistakes or be accused of providing substandard care.

Nurses are more likely to be sued than doctors because they often have direct contact with patients. They also handle simpler medical tasks such as taking blood pressure or giving injections, which makes them more susceptible to mistakes.

Malpractice insurance can help protect nurses against the financial consequences of such claims, including the cost of legal defense and any damages that may be awarded. If you are not convinced, let’s see the pros and cons of malpractice insurance.

Pros

- Pay a small fee for your peace of mind

- Protect your assets and license

- You can cover legal fees and lost wages

- Legal representation to negotiate settlements

- You will be covered for your students if you work in academia

Cons

- Premiums can be expensive

- You may still have to pay out-of-pocket expenses

- It won’t cover intentional acts or gross negligence

Do Nursing Students Need Malpractice Insurance?

Yes, nursing students need malpractice insurance. Nursing students may provide patient care under the supervision of a licensed nurse or physician. Suppose something goes wrong and the nursing student is found liable for damages. In that case, that student could be liable for medical expenses, pain and suffering, and other damages. That’s why nursing students need malpractice insurance to protect themselves financially in the event of an unfortunate incident.

What Are the Risks of Practicing Without Malpractice Insurance?

There are several risks associated with practicing without malpractice insurance, including:

- Financial loss: If a nurse is sued for malpractice and does not have insurance, they may be responsible for paying the full cost of legal defense and any damages awarded. This can be financially devastating, especially if the damages are substantial.

- Damage to reputation: A legal claim can damage a nurse’s reputation and credibility even if it is ultimately dismissed. This can have negative consequences for their career and future employment opportunities.

- Loss of employment: Some employers may require nurses to have their own malpractice insurance or may provide coverage as part of their employment benefits. If a nurse does not have insurance, they may not be able to be employed at these facilities.

- Lack of legal representation: Malpractice insurance typically includes legal representation in the event of a claim. Without insurance, nurses may have to represent themselves or pay for legal representation out of pocket.

Ending Thoughts

In conclusion, having nursing malpractice insurance is essential for any nurse who wants to protect themselves from potential legal claims or lawsuits arising from providing healthcare services to their patients.

While shopping around for a policy can be time-consuming and tedious, it’s always worth taking the time needed to find one that fits your budget and needs so that you have maximum protection against any possible issues down the line. With proper coverage in place, nurses can operate with more confidence knowing that they have taken steps toward protecting themselves from any unfortunate circumstances which may arise during their career.

Also Check Out:

- Disability Insurance For Nurses – What It Is & Why You Need It Today

- Car Insurance Discounts for Nurses

- Common Questions about Malpractice Insurance for Nurses – Fresh RN

- 9 Effective Ways For Building Confidence In Nursing

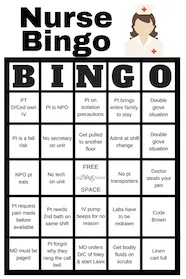

Download Nurse Bingo Today!

Liven up any shift with a fun game of bingo. See who can fill a row first!

Fill a whole card and lose grip with reality.

Your privacy is protected. We will never spam you.